Collective Health

For a design strategy project at Indiana University in 2017, we were asked by the UX team at Collective Health (a healthcare company) to think of ways to make the healthcare services offered clearer. The company is a third-party health provider that administers health plans and helps companies self-fund their employee's health benefits. They challenged several student teams to think of a way that will help client companies’ budget for employee’s care that caters to the employee’s needs.

My Role

Researcher

Designer

My Team

Mehul Agrawal

Matthew Brennan

Alice Gu

Duration

3 Weeks

Problem Statement

As a third party insurer, Collective Health wanted to track insurance, Flexible Spending Account (FSA) and Healthcare Savings Account (HSA) use. Our job was to find opportunities and strategies to collect this information.

In our research, we identified that employees of major companies have difficulty understanding the insurance and payment side of the healthcare system. Despite being on an employer’s healthcare insurance, they did not understand the medical process of referrals, insurance terminology and how to financially prepare for medical emergencies.

We challenged ourselves to tackle this question:

How can Collective Health collect information that helps client companies and its employees’ budget for healthcare emergencies?

Methods

Interviews

Purpose: We interviewed actuarial scientists, nurses, and doctors to understand the healthcare billing process. We also interviewed colleagues who have chronic health issues to understand how they navigated the healthcare billing process.

Stakeholder mapping

Purpose: After doing interviews, we drew up a stakeholder map which helped us showcase a comprehensive understanding of the aspects of the healthcare system that we were researching.

Document analysis

Purpose: We did document analysis of healthcare billing documents to understand what information presented was confusing.

Research Process

Challenges

Risk vs. financial understanding

I was tasked with interviewing actuarial scientists about the healthcare system. Since they calculated risks for insurance companies, I thought that they would be helpful in breaking down risk carried among insurance companies, the client companies, and the employees of client companies.

What we found was that actuarial scientist could not speak to the financial breakdown made by insurance companies. They could only talk about the calculation of risk, which was not helpful to what we wanted to find.

Understanding healthcare from a patient standpoint

So, we decided to focus on employees of client companies because they would directly interact with the healthcare system. In the continuing work, we would refer to them as patients.

Due to HIPPA and time constraints, two of my other teammates interviewed doctors and nurses who they knew personally. Our goal was to understand the pain points of what patients experience when going through the healthcare system. We also asked the doctors and nurses to refer us to patients who would be willing to talk to us.

We interviewed colleagues who struggled with chronic illnesses to gain a thorough understanding of the pain points experienced. To supplement the information given, secondary research was also conducted to understand the American healthcare system and the complications surrounding insurance.

Core Issues

Confusing insurance terminology and duplicate documents

The terminology used in healthcare statements were confusing. Plus, duplicate statements (e.g. EOB) makes the billing process more confusing. What is a TPA and HSA? And how does it affect co-pay?

How much should patients pay?

When do patients pay?

Who do patients pay and owe?

How does the patient know whether the medical institutions or practitioners are in-network or out-of-network? How can we make payment of services more transparent?

“You wouldn’t buy a new car or choose an item off a shelf without knowing the price up front, yet with medical and dental care members rarely know the total cost of the procedure and how much their insurance will cover, or if it will cover all aspects of a medical or dental visit.”

Lack of transparency because of private negotiated prices

By talking to Collective Health, we found out that a medical institution has negotiated different treatment prices with insurance companies. Since there are varying treatment prices, there is a lack of transparency in treatment.

Considering the core issues found, we did a document analysis of health insurance statements. The objective of the document analysis was to:

Understand the types of documents received by a patient

Find commonalities or terminology among the documents

Consider the types of interventions that could help in budgeting

The documents were the Bill Estimate from the hospital, the Bill Received from the insurance company, along with the EOB and the Final Bill. We noted that there was an identification code on each statement and hoped that it could solve financial transparency among patients. After doing some secondary research, we found that there was no standard identification code across all bills.

Design Considerations

With all the constraints considered, we decided to make the following design considerations:

Using OCR to scan the documents received.

Through the OCR, information from the documents would be translated using simple terminology.

Crowdsource in-network and out-of-network treatment prices in the area in order for companies to better budget for employee care.

Design Updates

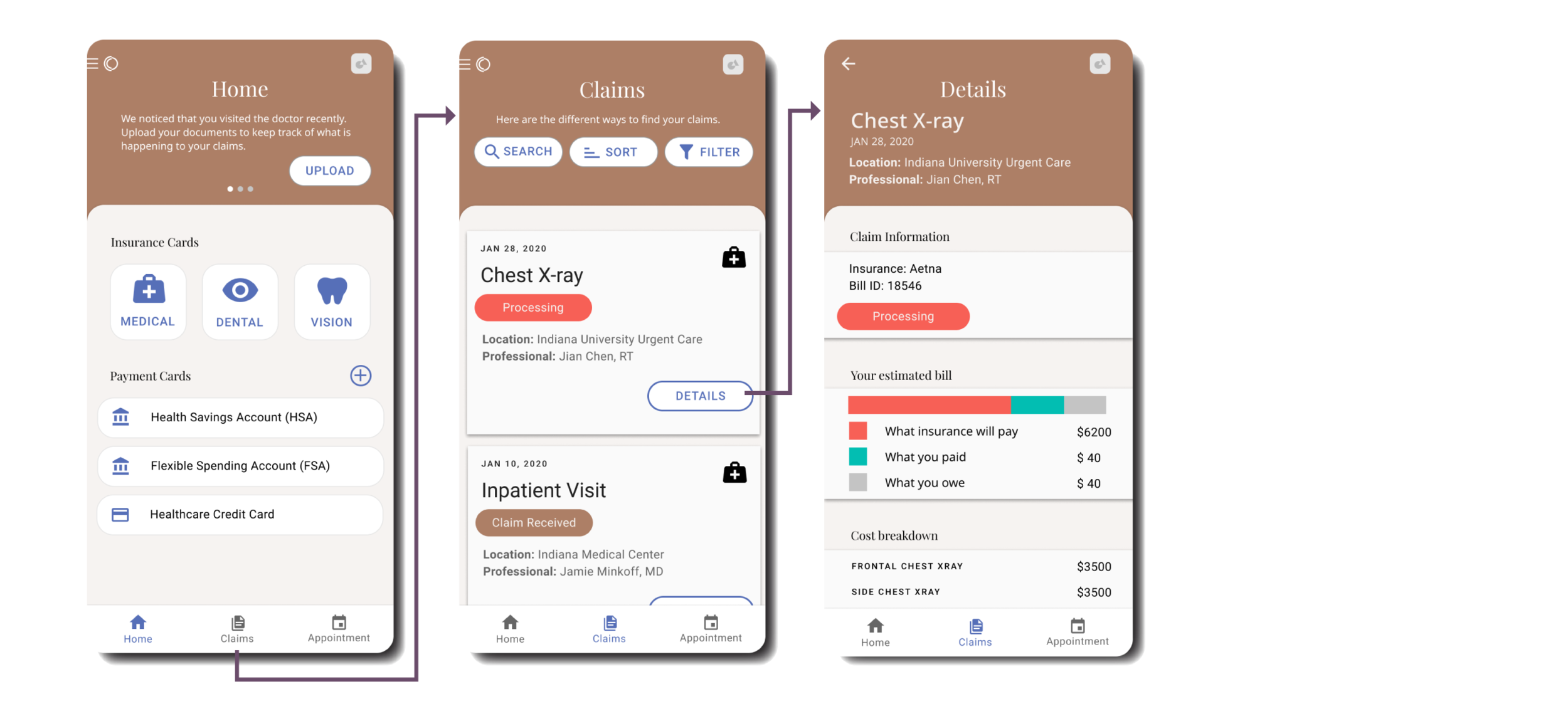

Since the completion of the project, I have updated the wireframes to improve the layout of the app. The design includes a homepage for users to access insurance cards, as well as add HSA accounts, TPA accounts and healthcare-related credit cards to the app. This process enables both Collective Health and client companies to track and budget for healthcare-related expenditure while allowing users to quickly get the information that they need.

Recommended strategy

With the information that we had gathered, we put together a stakeholder map to highlight 3 touchpoints that could address Collective Health’s needs.

The three touchpoints are the following:

S1 Scan and upload bills after visiting provider

S2 Track bills after bills are uploaded

S3 Manage user expectations through price crowdsourcing

Design Solutions

Touchpoint 1 : Scan and upload bills after visiting provider

Purpose

Enrich the database of Collective Health to provide better estimates.

Help the company track the member's’ health care activities.

What the user can do

The patient can opt into providing information.

The patient would be provided with clear terms and conditions.

The patient can take a photo of her bill and OCR would extract information from photo.

The information would be broken down in straightforward and understandable terms.

The font color and icon indicate that the bill is not final.

The design workflow to scan and upload bills.

Touchpoint 2: Track bills after statements are uploaded

Purpose

Both parties are allowed to track what is happening to the payment.

The patient is also notified when the insurance claims are being processed.

They can filter information to find the information that they need quickly.

What the user can do

The information in the dashboard can be sorted by date, status, type of care or category.

Viewing the financial breakdown of insurance claims.

The workflow for sorting and filtering claims

Touchpoint 3: Manage member price expectation

Purpose

The users can compare prices that are crowdsourced.

They can also see what procedures are covered by the insurance company.

Since prices are not an indication of quality, we also show out-of-network prices for patients to budget for.

What the user can do

When doing a search of medical care, they see price breakdowns of each procedure.

Trying to book for an appointment through the app.

What I learned from this project

Better terminologies

Terminologies, especially with medical care makes billing complicated for users. Even outside of the scope of this project, making terminologies more understandable reduces the reliance on onboarding and prior knowledge for users.

Regulations as constraints

While we could not consider all regulations, the project helped me learn that laws, guidelines and regulations are important design constraints for any user experience. For example, HIPPA law should be a constraint in the design of medical interfaces.

What I want to improve in the future

Testing design copy

While our research shows that users did not understand healthcare terminologies, I think that we should have tested our UX copy to evaluate whether our phrasing made it easier for users to navigate the healthcare system.